Estimated read time: 6-7 minutes

This archived news story is available only for your personal, non-commercial use. Information in the story may be outdated or superseded by additional information. Reading or replaying the story in its archived form does not constitute a republication of the story.

SALT LAKE CITY — Following the end of the Civil War, the U.S. banking system was growing by leaps and bounds fueled by industrialists who saw opportunity in the westward expansion and emerging transcontinental railroad systems that would connect new territories with the established businesses, and population, east of the Mississippi.

But then, as now, financial speculation in new technologies was rife with risk and not immune from financial turmoil outside the borders of the still expanding Union.

Ahead of the financial panic of 1873, a European stock market crash led to a mass capital exodus led by overseas investors who sank money into U.S. railroad bonds, once highly profitable investment vehicles, that were beginning to ebb in value as newly built railroad infrastructure outpaced demand.

In the summer of 1873, months ahead of an event that would mark the start of a full-blown U.S. financial crisis, President Brigham Young of The Church of Jesus Christ of Latter-day Saints called a meeting of local leaders to discuss organizing a new savings bank, a local institution that would create a financial safe haven for residents, many of whom had trekked into the Utah Territory during the previous 26 years.

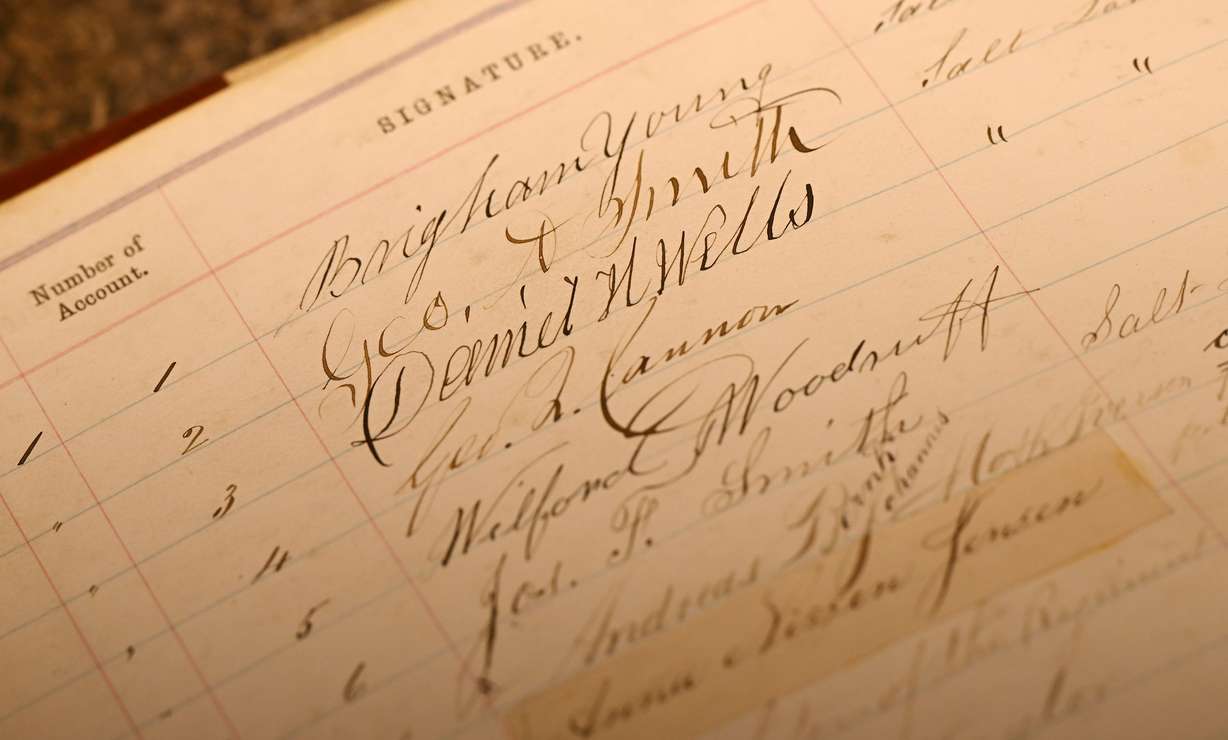

Just over a month after that first meeting, on Aug. 6, 1873, Articles of Association were filed to create Zion's Savings Bank and Trust Company and a few weeks later the Deseret News reported on President Young's optimistic outlook for the new endeavor.

"It will be found of considerable advantage to those who wish to save money for the emigration of their friends, as the interest is large and sums as low as $1.00 will be received, which, if continually added to, will soon reach a considerable amount, and the depositors will hardly miss the money," President Young said, according to a Deseret News story published on Aug. 22, 1873.

That early confidence would turn out to be well-founded as Zion's Bank and Trust, which officially opened for business on Oct. 1, 1873, would outlast most of its competitors of the era and this year will celebrate its 150th anniversary.

The beginning

Just a couple of weeks before the new bank opened its doors, in a turn of events that had a lot in common with the recent failures of U.S. banks over-leveraged in tech investments, the Philadelphia-based bank Jay Cooke & Co. was caught by a depositor run and overextension in railroad bonds that would lead to its failure. Subsequently, hundreds of businesses and banks would shutter their operations, tens of thousands lost their jobs and a period of national financial distress, now referred to as the Long Depression, would last until 1877.

But Zion's Bank and Trust would weather that storm, and many others, on its way to growing into regional banking powerhouse Zions Bancorporation, a multibrand financial institution that now boasts more than 400 branches across 11 Western states. Zions Bank is a division of Zions Bancorporation.

The secret to its longevity and success? Bank leaders say its all about staying true to the company's humble roots even as it has become one of the leading financial institutions in the country.

"I think it goes back to the concept that we have always believed banking is a local business," said Zions Bank President/CEO Scott Anderson in a Deseret News interview. "As we've grown it's been community-by-community and we've prioritized ties to those communities and personal relationships with every customer."

Anderson said Zions has expanded its depth and breadth as a company in lockstep with the growth of Utah and the West and its history can be viewed in two distinctive periods.

For its first 87 years, the bank was owned by The Church of Jesus Christ of Latter-day Saints and in those decades the bank's story closely paralleled the growth of the church, Anderson said. Up until 1957, the bank had a succession of nontraditional bank presidents — all of them leaders of the church. The appointment as bank president was generally a lifetime position for them, corresponding with their tenure as church president.

Second act

In 1960, a group of investors led by Roy W. Simmons bought out the church's majority ownership of the bank. This, Anderson said, began the bank's modern era and marked the beginning of a period of rapid expansion.

Simmons took on the role of chief executive in 1964 and two years later the company went public in a stock offering that helped raise capital to fuel growth and created a new parent entity that would become Zions Bancorporation. At the time Simmons acquired the bank, it was comprised of four branches and offices in Salt Lake City with total assets of around $120 million. By 1970, it had grown to 25 branches throughout the state and boasted assets of $300 million.

That was also the year Roy Simmons' son, Harris Simmons, started his first job at the bank, working part time filing canceled checks. Harris Simmons would continue putting in his time at the family business, working when time allowed during his undergraduate years at the University of Utah.

Harris Simmons would pursue postgraduate work outside of the state, earning an MBA from Harvard Business School. In 1981, he was back, taking on the role of chief financial officer for Zions Bancorporation. And, nine years later, he took over the CEO helm from his father.

In his leadership role, Harris Simmons continued the expansion arc begun by his father. He noted changes in federal banking regulations in the 1980s that helped open new opportunities to expand across Western states. Right now, Zions Bancorporation manages some $90 billion in assets.

In a Deseret News interview, Harris Simmons said that early on in the bank's history, President Young predicted that Zion's Bank and Trust would eventually expand throughout the Utah territory, an area whose borders encompassed most of Utah, Nevada and parts of California, Oregon, Idaho, Wyoming, New Mexico, Colorado and California. As it turns out, that's exactly what would come to pass, and then some.

As the bank has expanded its scope, Simmons noted the world of modern banking has also become a business driven by technology, and Zions Bancorporation has invested heavily, devoting some $400 million per year to its technology infrastructure and staffing.

"So much of the transactional part of the business is taking place via phones, devices and the internet," Simmons said. "We're intent on, and committed to, doing that well."

While the speed and ease of electronic transacting continues to reshape the banking world, Simmons said the business remains a people-centric effort and underscored that each branch, and the people who work there, build connections that go beyond banking and financial services.

"We are the steward of many billions of dollars of savings that belong to many, many individuals and businesses in the markets we serve," Simmons said. "We're employing those savings in investments in those communities, investments that make them better places to live. And, our people are highly engaged in terms of being involved in the communities where they live and work.

"The most appealing part of the banking business to me is we're in a position to use a balance sheet as well as our people to solve problems. And we hope we've been a real contributor over the years and will be for many years to come."

Photos

Show All 4 Photos